GARETH

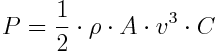

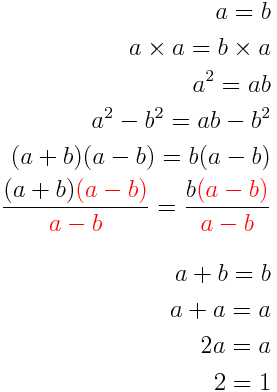

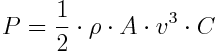

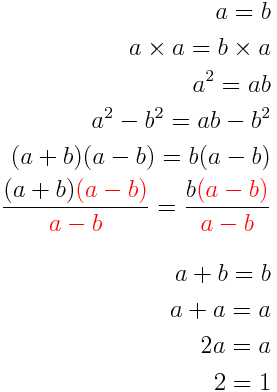

i think the first firmuka is fir the proof construction.

the A(t) in p14 is defined as r- n derivative * random discount factor , i think formula you quoted at bottom of your post is missing the random disocunt factor...

i think the split of r -n dervative (via exponential addition) is needed because

we are at time t and wish to price claim at T. so as the proof on 15 shows we have to break entire n (o,T) up into random n(t,T) and non random n (o,t) (as we know everything up to t) and then we are left with radon-nikodym derivative over (t,T)... and the rest of the manipulation leaves us with the stochastic discount factor over (t,T) and hence deflator over (t, T)

so Expectation ( deflator(t,T) GIVEN Ft ) under P reduces to usual Q risk neutral formula over t,T)

please correct me of i am wrong, but proving equalivalece of deflator and risk neutral approach at time 0 of a claim at T would not require any split of r-n derivative..

im sorry, gareth, but i havent yet learned the maths equation editor so as usual my symbology is poor

also thank you very much for looking over question 3 in sept 05 paper (my thanks extends to mtm, ollie and others on this forum who commented)..it was a relief to know i wasnt the only one who was confused by the "TYPO"!!!

regards