P

phos2

Member

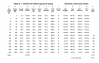

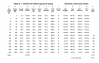

In the notes we have the following table:

Which is found in chapter 15. The section is talking about using exposure curves to price treaty XoL. I don't understand what column E represents? Is it the incurred loss ratio? The cedants expected loss ratio (if so why give credibility to it?)? the reinsurers expected loss ratio for the rate?

Could someone explain how this is derived? If we had data on a per policy basis where would we get this figure from?

If we wanted to repeat this exercise but using ILFs e.g. for casualty treaty XoL; how would it be done? Would we need individual limit profiles?

Which is found in chapter 15. The section is talking about using exposure curves to price treaty XoL. I don't understand what column E represents? Is it the incurred loss ratio? The cedants expected loss ratio (if so why give credibility to it?)? the reinsurers expected loss ratio for the rate?

Could someone explain how this is derived? If we had data on a per policy basis where would we get this figure from?

If we wanted to repeat this exercise but using ILFs e.g. for casualty treaty XoL; how would it be done? Would we need individual limit profiles?