I always have doubt about the premium conversion equation for Assurance paid immediately.

Which one is correct?

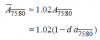

i) \( \bar A_x = \left(1+i\right)^{0.5} \left(1 - d \ddot a_x\right)\)

OR

ii) \(\bar A_x = 1 - \delta \ddot a_x\)

extended to contingent benefits... Some solution used as...

AND

Last edited by a moderator: Mar 17, 2017